Many Americans are struggling with the high cost of health care. For some families, relief may be available through one of the lesser-known national health care programs.

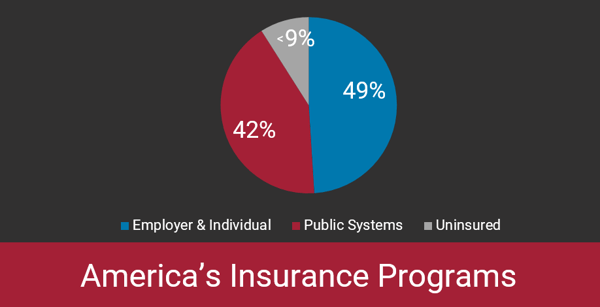

According to a KFF analysis of 2016 data, 35 percent of people in the United States receive their health care through a public program. While Medicare and Medicaid are the most common, 2 percent of people get their health insurance through other public programs, including TRICARE and CHAMPVA. This blog post is about the latter, CHAMPVA.

The Civilian Health and Medical Program of the Department of Veterans Affairs, or CHAMPVA for short, is the health care program for the spouses and children of disabled or deceased veterans. Families enrolled in CHAMPVA can also purchase a supplemental insurance policy to help keep their health care costs under control.

Who Qualifies for CHAMPVA?

According to the U.S Department of Veterans Affairs, CHAMPVA coverage is available for individuals who fall into one of the following categories:

- The spouse or child of a veteran whom a VA regional office has rated permanently and totally disabled for a service-connected disability.

- The widow, widower or child of a veteran who died due to a VA-rated service-connected disability or while rated permanently and totally disabled from a service-connected disability.

- The widow, widower or child of a military member who died in the line of duty and not due to misconduct, if they are not eligible for TRICARE.

Individuals who qualify for both CHAMPVA and TRICARE, the health care program for active duty and retired uniformed service members, will enroll in TRICARE.

How Does CHAMPVA Coverage Work?

According to the CHAMPVA Guide, when seeking medical services and prescriptions, CHAMPVA enrollees have many options. These options may include VA providers, non-VA providers, the Meds by Mail program and pharmacies. CHAMPVA does not have a network of providers, but many providers that accept Medicare and TRICARE also accept CHAMPVA.

Depending on where they receive care and prescriptions, CHAMPVA enrollees may have out-of-pocket costs, including deductibles and co-pays. Co-pays can be 25 percent of the total allowable cost.

Can Someone Have Coverage Through CHAMPVA and Another Health Plan?

Sometimes, people can reduce their medical expenses by using multiple health care plans.

According to U.S. Department of Veterans Affairs, it is sometimes possible to have CHAMPVA coverage and another health insurance plan simultaneously, although individuals who qualify for CHAMPVA and TRICARE must enroll in TRICARE and cannot enroll in CHAMPVA.

Individuals who qualify for both CHAMPVA and Medicare must enroll in Medicare Part A and Medicare Part B, but they can continue enrollment in CHAMPVA. Medicare will be the primary payer, and CHAMPVA will be the secondary payer.

Additionally, individuals who are enrolled in CHAMPVA may choose to enroll in a CHAMPVA supplement insurance plan as well.

Should You Purchase a CHAMPVA Supplement Insurance Plan?

For people who are enrolled in CHAMPVA and don’t have access to Medicare or other public programs, a supplement insurance plan may provide important assistance.

Because CHAMPVA enrollees may be charged 25 percent of the total allowable cost for services and prescriptions, injuries and illnesses can lead to major out-of-pocket expenses.

A CHAMPVA supplement insurance plan can help enrollees keep their out-of-pocket costs down. Although enrollees have to pay a premium and deductible for their supplemental policy, the policy covers co-payments. This can help enrollees stick to a budget and avoid unexpected costs.

If you worry about unexpected medical costs, a CHAMPVA supplemental policy could help you keep costs under control while giving you peace of mind. This is especially important if you suffer from chronic health conditions, take prescription drugs or have other reasons to expect your medical costs to be high.

Learn more about CHAMPVA supplement insurance policies.