Recently, our blog editors sat down with company president David Selman, who shared insights about the five different market segments served by Selman & Company. We asked about changes and trends in these markets and what it means for employers, carriers, and brokers.

Q: There has been a lot of change in the third party administration (TPA) market as well as at Selman and Company, and I wonder if you could shed some light on the different market segments that you serve.

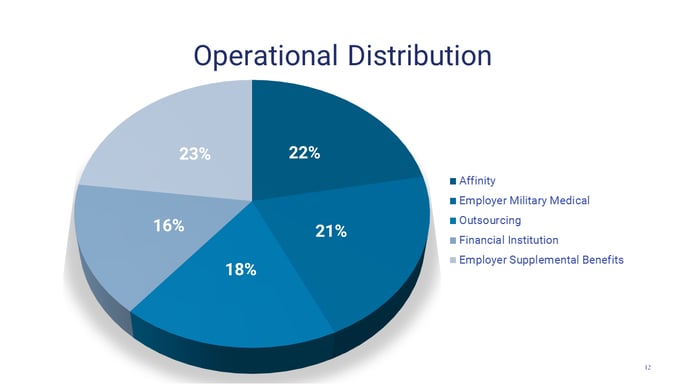

A: If you look at our operational distribution chart [below] you can see the breakdown of each of the five market segments we serve. Let’s start with the 22% that is our block of affinity business. That was over 90% of our business about 20 years ago. It's continued to grow because we've picked our spots carefully, we bought some businesses, or bought business that fits in that space. We like that kind of business for administration, but it's a mature market. The reason why is because group membership is declining in the US due to all kinds of factors, such as the ease of searching online for professional skills and networks. Most people, especially millennials, don't need to join an association to make those connections. It's hard to build a future around a shrinking business where fewer and fewer people are joining a professional or trade association. However, other types of affinity groups may still be a helpful conduit for insurance offerings. Our longstanding expertise in this market should continue to serve us well.

Q: You mentioned that the affinity or association business is shrinking. How did your experience in that market segment impact where Selman and Company decided to go next?

A: Our experience with affinity groups led us into the financial institution business - banks and credit unions. We now work with over 800 of them. Today, credit union membership is growing at 6% per year. This is a good business for an insurance administrator. Again, it's similar to affinity groups: If we find opportunity we're well-positioned to dig in deeper even as the market changes.

Q: Can you give some insight into how Selman and Company decided to target the outsourcing market?

A: Many of our peers were actually organizations focused largely on selling insurance, and servicing those policyholders was secondary to them. As a way to differentiate ourselves, I decided that we should focus our attention on becoming the finest possible insurance administrator. And so, unlike our peers, who did administration because they had to, we were going to get really good at it. I decided we were better off becoming best in class as an administrator because I didn't see an equally clear path to becoming best in class as a distributor. We started serving insurance companies, so they could lower their costs and improve their efficiency if they outsourced administration to us. We like that business, too, and I think that there's room to grow there.

Those three were the first three blocks of our foundation: affinity, financial institutions, and outsourcing. Then, three years ago, and again in February of 2017, we bought big businesses: ASI and Vision Financial Services, respectively. One specialized in employer military medical insurance and the other in voluntary benefits administration. These were the 10th and 11th successful acquisitions since our founding nearly 40 years ago.

Q: Employer Military Medical...What is that?

A: That is the block of business that we acquired with the purchase of the business of ASI (Association and Society Insurance Corporation) three years ago, and it is really centered on the TRICARE supplement product that we offer to eligible U.S. Armed Forces military personnel, military retirees, reservists, and their dependents. I think this product is appealing and has tremendous growth potential. In fact, 21% of our business is devoted to TRICARE Supplement for employers so it's big for us, as well. The issue we have is that a lot of the eligible military members are not aware the product exists, so educating customers in this segment about this type of insurance is kind of tricky.

Q: I see that our largest segment is the employer supplemental benefits business, and you mentioned that the lines can get a little blurry. Can you expand on that?

A: Nearly a quarter, or 23%, of our operations are devoted to employer supplemental benefits, also known as voluntary benefits administration. The lines blur a bit when we talk about this segment because there are a lot of "outsourcing services" in the employee supplemental benefits business. We provide combined billing solutions for multiple carriers and products as well as simplified reconciliation of billing payments. The employer supplemental benefits business is what we acquired when we purchased the assets of Vision Financial Services in February of 2017.

This is a broad market segment. There are more than 300 million Americans, and 151 million of them go to work every day. For those workers, they might have a few options for medical plans, but what they get largely is a one-size-fits-all benefit package. They get the same amount of life insurance or disability coverage because the employer provides it. And that one-size-fits-all approach makes less and less sense.

Q: Where do you see the employer supplemental business moving in the future?

A: Employees and employers appreciate the "Good Housekeeping" seal of approval and the efficiency that goes with having an employer provide voluntary benefit offerings that the employee can elect through the workplace. But that ecosystem doesn't have administrators. They have insurance companies, or product providers, who do the ongoing admin themselves. So, if you're an employee and your employer provides life insurance, and critical illness coverage, and identity theft protection, and pet insurance, or whatever they offer, your employer is telling you, "You have to go to each of those places to be served." That's inefficient.

Q: How can a TPA solve that inefficiency issue?

A: As a pure administrator, we can focus on fixing this problem. We don't have distribution, we are often not required to take enrollments, and we're not a manufacturer. But, we can provide seamless administrative services no matter who the product provider is. No other company is really doing that in this space. I want us to grow here, and I think we can because of the unique value we bring.

Q: Thanks for taking the time to have this discussion. Any parting thoughts?

A: We're a niche insurance marketer and administrator, and we're over six times larger than we were when I got my job a long time ago. We are diversified across several market segments. Plus, we are pretty balanced among them, which is good when regulations change or the economy fluctuates. That's pretty impressive for a privately-held, family-run business that has grown all this from the ground up.

For more information about third party administration services, please contact us today.