A new year means new changes for everyone who is covered under TRICARE, the health insurance plan for the military community. One of the TRICARE changes going into effect as of February 1, 2018 is an increase of co-payments for prescription drugs. Even with a comprehensive health insurance plan like TRICARE, beneficiaries must still pay for some costs, like Rx, out-of-pocket. A TRICARE Supplement helps cover these out-of-pocket costs. As the TRICARE cost share increases, so does the proportional value of a TRICARE Supplement insurance plan. Today, we look at how this type of insurance can save vets and their families a lot of money for medications.

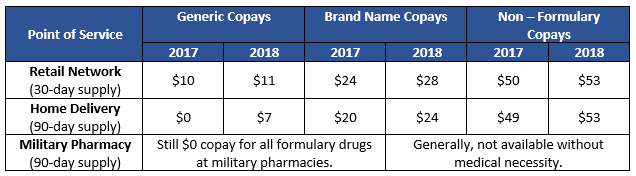

According to Defense Health Agency (DHA), TRICARE will be increasing the amount TRICARE beneficiaries must pay when they obtain prescription drugs. While modest in dollar terms, the prescription changes range from a 1% increase for retail generics to a 20% increase for brand name drug copays through mail order. The changes are increasing as shown below:

Source: https://tricare.mil/About/Changes/Pharmacy

With co-payments rising, vets and military families covered under TRICARE might be wondering how they can reduce their out-of-pocket costs without limiting their consumption of prescription drugs. Meet the TRICARE Supplement insurance plan. This is a little-known type of supplemental insurance that helps cover the costs TRICARE leaves behind. Senior Americans who have Medicare might be aware they can purchase optional Medicare Supplemental insurance to cover what their standard coverage doesn't pay. TRICARE Supplemental insurance works similarly: After the TRICARE beneficiary pays his or her deductibles, TRICARE pays its portion, and the TRICARE Supplement helps reimburse the beneficiary for remainders. The amount of savings delivered by having a TRICARE Supplement plan varies from person to person. No matter who is covered by a supplement, this type of insurance can help save any family on prescription costs after deductibles are met.

Example Prescription Savings*

To illustrate the point, let's meet John (not his actual name), a TRICARE beneficiary who currently works as an airline mechanic in Texas and retired from the Navy after many years of service. He heard about the TRICARE Supplement, got a quote, and then spoke with a Selman & Company representative to discuss his coverage options. John was really concerned about rising health care costs because his family didn’t have much leeway in their monthly budget for unexpected healthcare expenses. He explained how cash was tight and how his two sons will be in college at the same time in two years. He remarked, “When my wife told me about the TRICARE Supplement, I was excited because it will help me control costs. Plus, it gets my kids covered, too. I didn’t even know I qualified!”

John, 51, his wife, 48, and two sons are covered under TRICARE, and in 2017 they had mail order prescriptions for John's cholesterol medication, his wife's thyroid medication, his son's ADHD prescription, and seven incidental prescriptions for generic antibiotics, topical creams, and pain killers obtained from retail pharmacies. Here are his 2017 and 2018 costs compared:

| Drug |

2017 Out of Pocket |

2018 Out of Pocket |

2017 Annual Total |

2018 Annual Total** |

| Atorvastatin Calcium, 80mg (generic Lipitor) | $0/30-day supply | $7/90-day supply | $0 | $28 |

| Synthroid, 100mcg (brand name) | $20/90-day supply | $24/90-day supply | $80 | $96 |

| Abilify, 15mg (brand name) | $20/90-day supply | $24/90-day supply | $80 | $96 |

| 6 generic prescriptions, retail pharmacies | $60 | $66 | $60 | $66 |

| 1 non-formulary prescription, retail pharmacy | $50 | $53 | $50 | $53 |

| Total | $270 | $339 |

Source: ExpressScripts Federal Pharmacy Services

**Copay increases don't take effect until Feb 1, 2018, but these estimates show 12 months of costs.

In 2017, John's famly Rx costs were $270, and in 2018, his costs for the same medications would jump to nearly $340. As this example indicates, pharmacy costs can get very steep for beneficiaries who prefer the convenience of retail pharmacies. The changes will also come as a shock to vets who have been used to free mail order generics and to family members who use non-formulary medications.

The good news is that John's cost for these prescriptions in 2018 could be $0 if he had purchased a TRICARE Supplement insurance plan for himself and his family members. Costs like these are covered for a family like John's. Take a look at this video below that does a cost comparison of two TRICARE beneficiaries--one who has a supplement, and one who doesn't:

Help Solve TRICARE Cost Problems

Many people with TRICARE try to limit costs by adopting some cost-cutting strategies:

- Skipping or postponing medical treatments to avoid incurring co-pay charges

- Cutting pills or stretching medications to avoid paying prescription cost shares

- Driving a long way to get to a specific medical provider’s office

Sometimes, their health situation just ends up costing more than they would have liked, due to circumstances beyond their control. If you have TRICARE, you may have:

- Paid unexpected fees from a big medical bill

- Avoided seeing a specialist because getting a referral was a hassle

A TRICARE Supplement insurance policy addresses these issues by helping to reimburse beneficiaries for prescriptions and doctor visit copays. If you have a TRICARE plan with network limitations, a supplement expands your choice of in-network health providers. With a supplement, most out-of-pocket prescription costs will be zero. Sure, getting reimbursed for pharmacy costs is great, but it's also valuable to have the peace of mind to know what your costs will be.

Rising Copays = Rising TRICARE Supplement Value

As TRICARE copays continue to increase, the value of the TRICARE Supplement rises, too. This type of insurance policy works with your TRICARE health insurance to help you cover costs that TRICARE does not cover.

For more information about our TRICARE Supplement (or the very-similar CHAMPVA Supplement), please complete the form on this page, and include your phone number:

*As with any insurance product, you'll need to carefully review the plan materials. Your actual savings may vary, depending on how you incur cost and how you configure your TRICARE Supplement plan coverage options. It's insurance, so there is a lot of fine print!